Many small businesses are having to deal with the difficulty and complexities of understanding Beneficial Ownership Information Reporting (BOIR). Part of this complexity is understanding who can file your BOIR, who has to file a BOIR and where you can file your BOIR. In this article we will break down who has to file a Beneficial Ownership Information Report, and where you can file.

Who Can File a Beneficial Ownership Information Report (BOIR)?

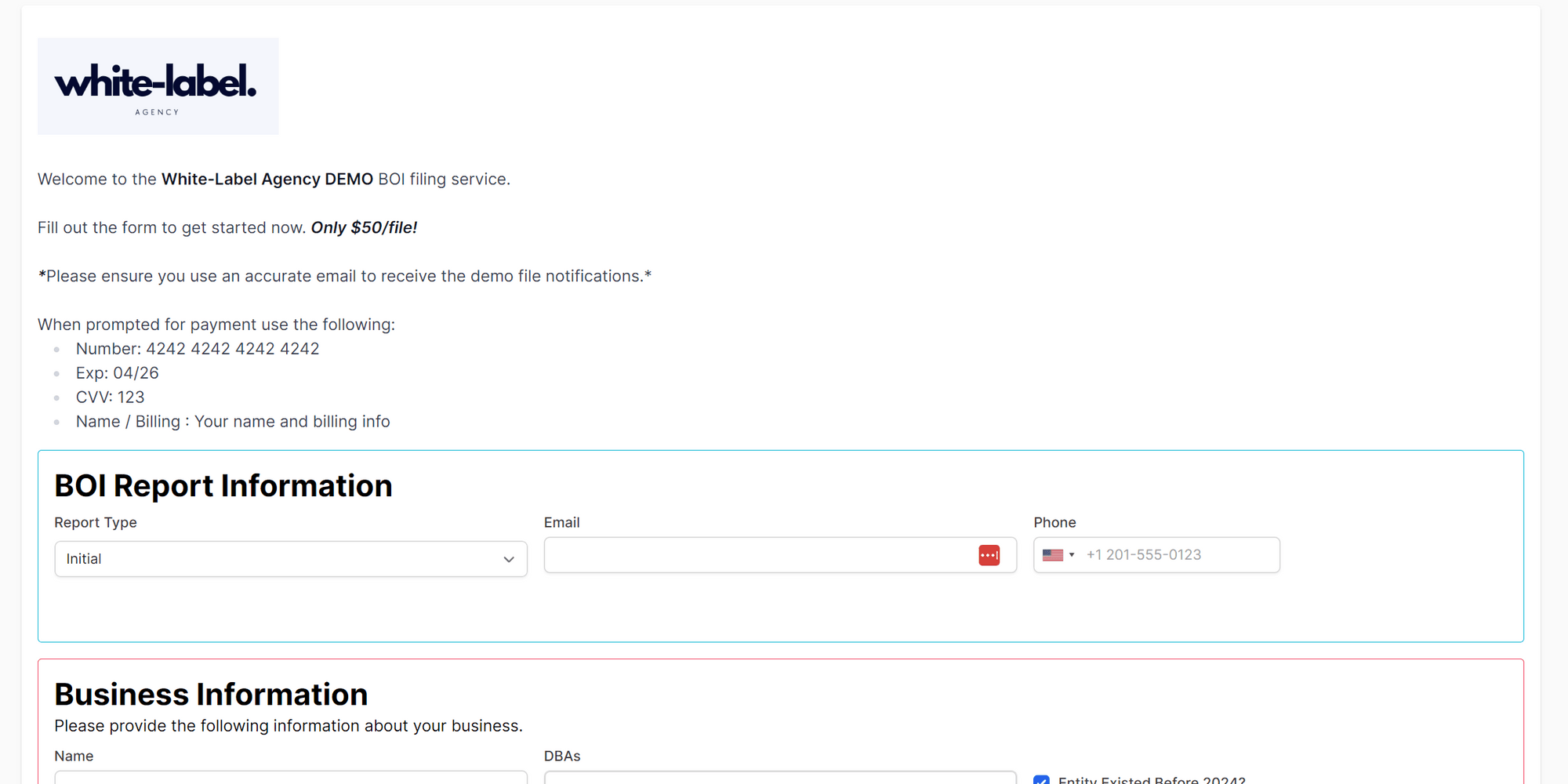

Beginning this year (2024) the Corporate Transparency Act (CTA) now requires small businesses to file Beneficial Ownership Information Reports. Ensuring you file your BOIR will keep your company from fines and other severe penalties. For businesses that need to file this report you may be asking who can actually file your BOIR? Simply put beneficial owners, company applicants, and authorized representatives (CPA, filing services, etc) can file your BOIR.

![[object Object]](https://umsousercontent.com/lib_oGPegMrabyGMZISx/nbzg7nzv9wewqh0s.png?w=400)