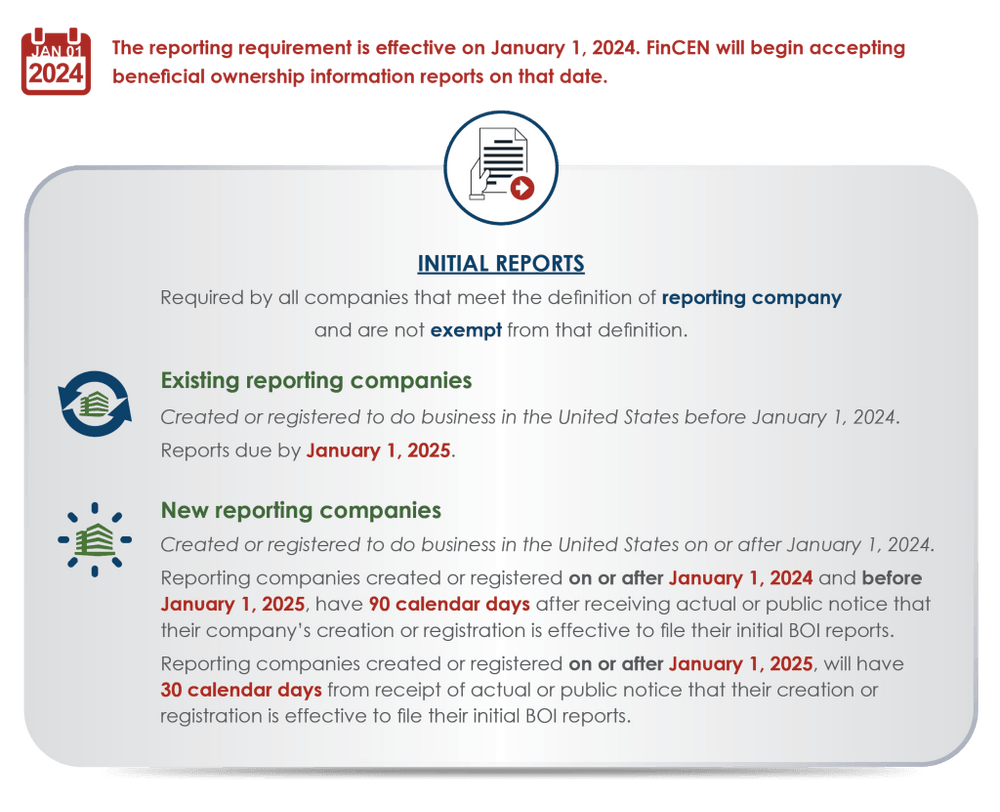

Beneficial Ownership Information Reporting is the new tax filing that can turn your $300 LLC into a $10,000 fine or jail!

Which of your businesses does it apply to, and how do you stay legal?

In plain English with links and pictures.

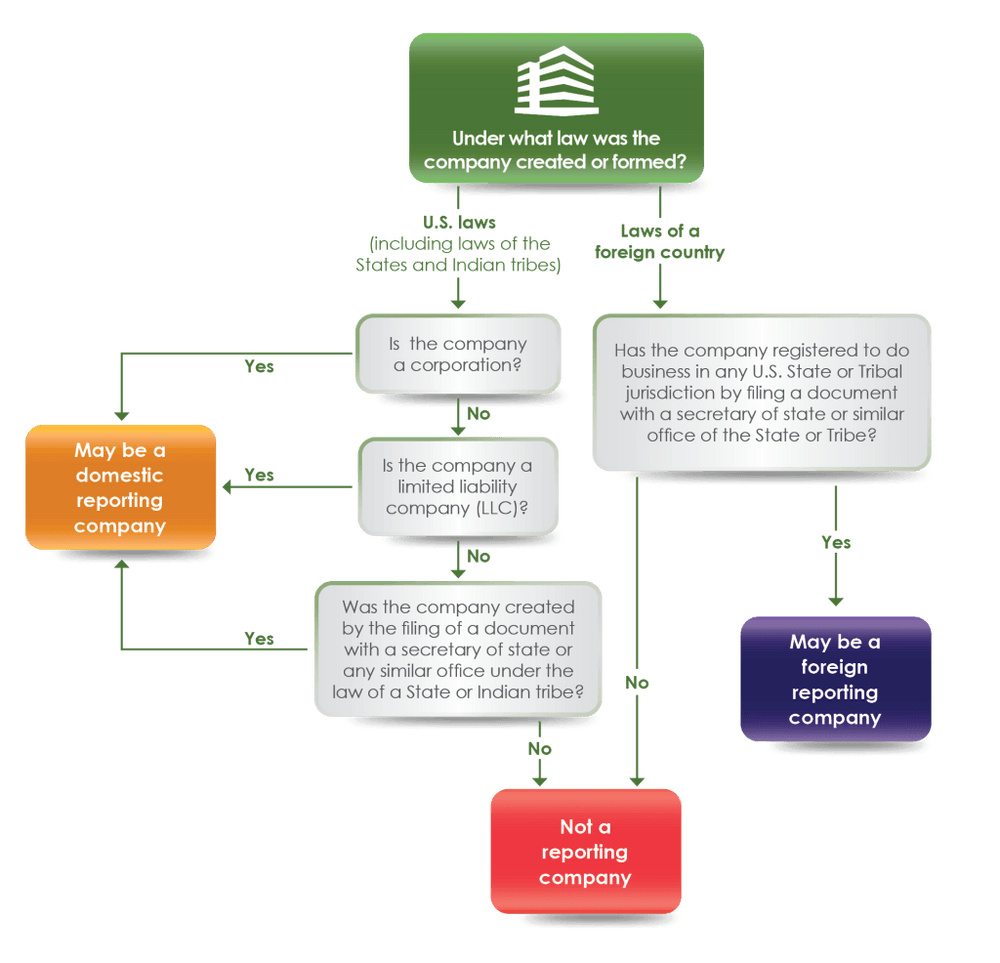

Who has to file?

In general, think LLCs, Incs, LPs, and GPs that are under 20 employees or $5MM in revenue.

Think start-ups, sole proprietors, and non-SEC registered investment LLCs.

If you are a solopreneur or SMB, this is likely you!

(See also: Who has to file beneficial ownership information?)

![[object Object]](https://umsousercontent.com/lib_oGPegMrabyGMZISx/nbzg7nzv9wewqh0s.png?w=400)